CapitaLand Investment (CLI)’s Chief Sustainability & Sustainable Investments Officer, Vinamra Srivastava posed a blunt question at the NUS-IREUS REThink Carbon in Buildings Forum on 31 October 2025.

“When you put $100 into green capex, what do you actually get back?”

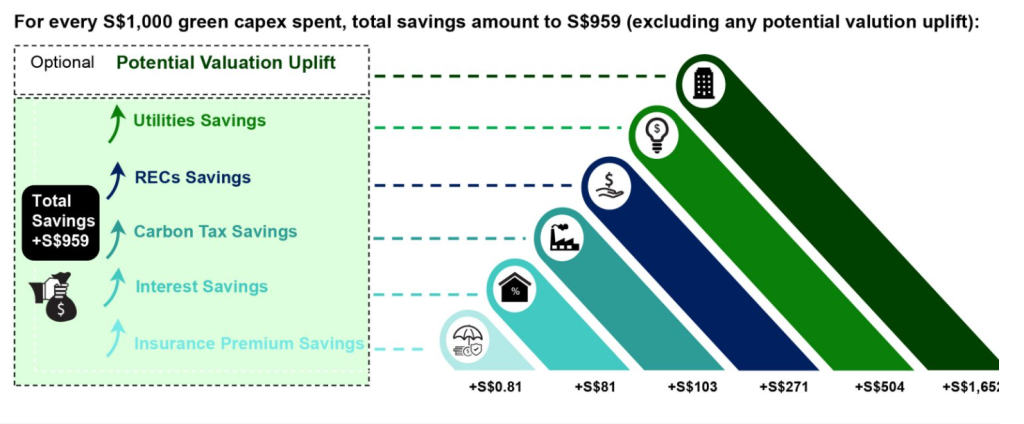

CLI decided to answer this empirically by building a model to track Return on Sustainability.

Moving Beyond the “Green Premium” Myth

“Most global studies show that certified green buildings enjoy higher rents. But when I show this to my leasing teams,” Vinamra said, “they tell me they’ve never had a tenant who paid a dollar more just because a building is greener.”

That disconnect led CLI to look deeper. Instead of relying on rental uplift, the team identified eight financial levers that green investments could influence, from lower utilities and carbon costs to faster leasing, lower interest rates, reduced insurance premiums and asset-value appreciation.

To test this, CLI analysed six live assets across its global portfolio, including office towers and retail developments in Singapore, India, Australia and Europe, inserting the sustainability variables directly into each project’s financial model.

What the Numbers Actually Showed

Take one asset in India, a 1.2 million sq ft office development. When a major energy company launched its RFP for a new back-office, its condition was simple: the building had to be powered by 100% green energy.

“Only two developers in the city qualified,” said Vinamra. “That’s what we call a brown discount, not losing rent, but losing the deal.”

Across the sample, CLI found that: Four of six assets saw a positive IRR uplift, even after factoring in the cost of retrofitting. Utility savings alone recovered a significant share of the green capex, driven by more efficient HVAC and lighting systems.

Carbon-tax savings in Singapore added another layer of measurable return, especially as Singapore’s carbon price climbs to $50 per tonne by 2030. In markets without a carbon tax, savings came from buying fewer renewable-energy certificates (RECs).

When CLI applied the model to a portfolio of Singapore assets, the results were near break-even even without counting potential valuation gains.

Add in modest cap-rate compression, and the uplift exceeded 1.6 times the initial investment.

Matching Strategy to Capital Structure

Not every investment horizon delivers the same payoff. Vinamra highlighted that a private fund with a five-year exit will have a very different decarbonisation pathway compared to a REIT with a long-term hold.

“Two identical buildings, one in a private fund, one in a REIT, will likely have two different green strategies. The capital source matters as much as the asset type.”

The Takeaway

CLI’s Return on Sustainability framework reframes ESG not as a cost, but as capital discipline:

“Be scientific. Be deliberate. Your green capex won’t always yield the same result for every asset but if you measure it right, it will make sense for your portfolio.” – Vinamra